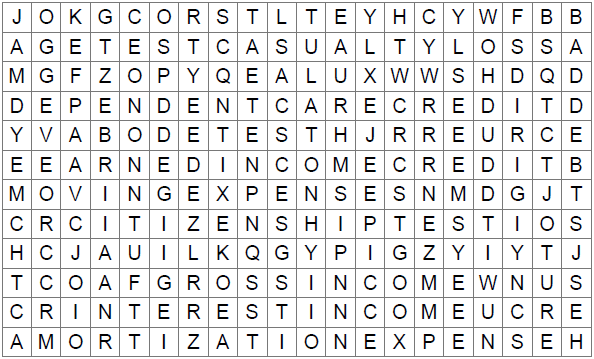

Find the hidden words. The words have been placed horizontally, vertically,or diagonally.

- These generally reduce the amount of tax shown on the return.

- A qualifying child must live with the taxpayer for more than one-half of the year.

- This credit applies to those taxpayers who pay for dependent or child care in order for them to work.

- Generally included as gross income _________ is reported on Schedule B.

- This credit provides qualifying taxpayers with relatively low levels of income a credit against their tax liability.

- All income, from whatever source derived.

- Is allowed for the qualified costs of moving in connection with starting work at a new place of business.

- The cost of recovering intangible assets such as leasehold improvements and other Section 197 intangibles.

- A _____ ____ is sudden and unexpected,and may include a theft loss as well.

- A qualifying child must be under the age of 19, or if they are a full-time student, underthe age of 24.

- When a taxpayer extends credit to another taxpayer in the form of a loan, and then the loan becomes uncollectible.

- The dependent must be a citizen or resident of the United States, or resident of Canada or Mexico.

Words

- Tax Credits

- Interest Income

- Amortization Expense

- Casualty Loss

- Earned Income Credit

- Moving Expenses

- Abode Test

- Age Test

- Bad Debts

- Gross income

- Dependent Care Credit

- Citizenship Test