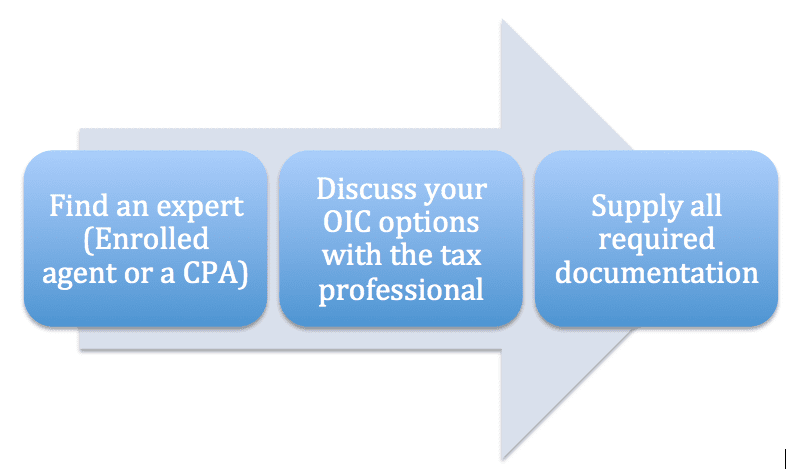

An IRS Offer in Compromise (OIC) is heavily marketed strategy to reduce a tax liability. While many companies promote their expertise, you need a enrolled agent or CPA to guide you through this complex process.

This post explains an overview of the OIC process, why offer are rejected, the three approaches used to justify the offer, and how to use the doubt as to liability approach.

If you’re a tax professional who provides tax resolution services, Lambers provides a 10-course Tax Resolution Series to help professionals sharpen their skills, and find new business. Click Here to find out more!

Just how large is the tax delinquency problem?

An overview of the tax delinquency issues

At the end of fiscal year 2018, there were over 14 million individual tax returns (Form 1040s) with a balance due, totaling $128 billion in tax liabilities (per IRS Delinquent Collection activities reports). During the same period, 2.3 million tax delinquency investigations were conducted.

59,000 Offers in Compromise (OICs) were submitted, with 24,000 accepted (about 40%), collecting over $261 million. Less than 50% of OIC agreements are accepted, and there are several reasons why.

If you’re an enrolled agent, Lambers offers quality continuing education courses, with great customer service and affordable prices. Find out more here.

Reasons why offers are rejected

The reasons for rejection are driven by the taxpayer’s lack of proper preparation and follow up:

- Incomplete applications: If data is incomplete, the IRS may return the data, or set it aside and work on complete applications.

- Taxpayer not in compliance: Lack of compliance due to tax returns that have not been filed. Note: A current year tax return with a valid extension is considered to be in compliance.

Reasons for the OIC program

The OIC program allows the IRS to collect more money in less time, and using fewer staff hours:

- IRS can collect some funds from taxpayers who would otherwise never pay (Some taxpayers simply go off the grid)

- Receive payment from funds that otherwise could not be tapped (family loans, for example)

- Collect more money than trying to seize and sell taxpayer property, which is time consuming for IRS staff

- Compliance: Once the OIC is in place, the taxpayer must stay in compliance,

The IRS has a limited staff, and is looking to speed up the collection process to collect as much as possible.

Understanding two important tax forms

Many former IRS Revenue Officers work as enrolled agents and assist taxpayers with the OIC process. To start the process, it’s important to distinguish between two forms:

Form 656: This form lists amount of the offer and the terms

Form 433 (OIC) is a form called Collection Information Statement for Wage Earners and Self-Employed Individuals

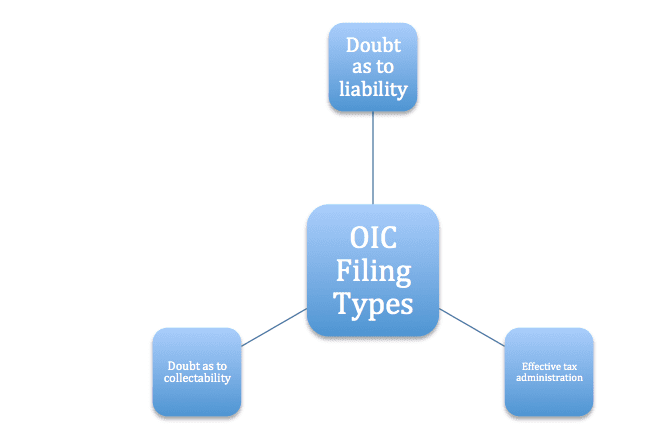

The time intensive part of completing an OIC is providing the financial data in Form 433. The three types of OIC filings are: Doubt as to liability, effective tax administration, and doubt as to collectability.

This post explains doubt as to liability, and the two other OIC filings are explained in other posts.

Doubt as to liability

The IRS Form 656-L is used if taxpayer disputes the amount of the debt. In this scenario, the taxpayer doesn’t believe that they owe the balance due, or that a much smaller balance is owed. Here are the common reasons why:

- Audit: Poor representation by a third party who didn’t file proper documentation, or missed deadlines for reconsideration (or both). The taxpayer must prove why original tax assessment was wrong.

- Innocent or injured spouse: Late or incorrect filings

- Identity theft: It’s not the taxpayer’s tax return. The taxpayer didn’t received refunds generated by a fraudulent return, which used the taxpayer’s Social Security number.

- Forged return (Typically a spouse): If this occurs, the spouse must file a new return using married filing separately status.

Other requirements

- Genuine dispute as to the amount of correct tax debt owed under law

- No final court decision or judgment exists

- Only accepted for tax periods in question

Documents that must be included:

- Form 2848 Power of Attorney: Giving enrolled agent POA. If two spouses, each needs separate POA signed.

- Form 656L: Spouses can fill out the form jointly, and the form can be used for personal and business tax returns. Make sure to name the specific tax years in the document.

- Documentation: Explain in writing why you doubt the amount owed, with supporting documentation

Completing the form

Keep these points in mind as you complete the form:

- Offer to pay: State the amount you propose to pay on Form 656L

- If payments have been levied: File Form 656L immediately to avoid missing a deadline for attempting to recover payments.

- Deadline for IRS: IRS must make a decision within 24 months, or offer is accepted automatically. Send the OIC with proof of delivery.

- Explanation of circumstances: Explain why the IRS amount is not accurate.

- Third parties: Notify third parties, provide contact info, and give permission allowing IRS to contact third parties to support your position. A common example: A 1099 dollar amount contains an error, and the payor can explain to IRS.

The main reason for an OIC rejection: documentation is missing, or not supplied in a timely manner. So, where do you go from here?

Consult with a tax professional (CPA or enrolled agent) on all tax-related issues. Best of luck.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/