Millions of People Need Your Help

Invest a mere 20 hours in our Tax Resolution Certificate series, earn your certificate of completion as a Tax Resolution Specialist, and get on your way to earning your fair share of this billion-dollar market.

Why is Tax Resolution such a hot topic?

- There are currently 11,375, 720 taxpayers who owe over 125 billion in back taxes to the IRS.

- There are an estimated 7 million unfiled income tax returns.

- Last year there were over 30,000 Offers In Compromise submitted to the IRS. Less than 40% were accepted. One of the biggest reasons the IRS rejects an OIC is because of incomplete or inaccurate information.

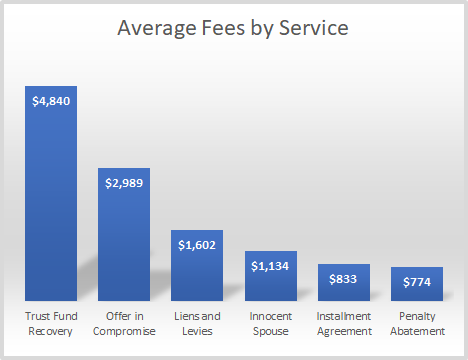

- The average fee last year for an Offer in Compromise was $2,889. How many returns do you need to earn $3,000? Plus, solving people’s tax problems will make them genuinely appreciate your work. Make three or four times the money and work half the hours.

2024 is forecasted as a record-breaking year for tax problems.

As a tax professional, are you ready to take advantage of this once in a lifetime opportunity?

Earn your Tax Resolution Specialist certificate now and start earning your fair share of this business.

BONUS OFFER #1: FREE 2 Hour Course

Keeping Taxpayer Data Secure – Updated for 2024.

BONUS OFFER #2: 5 FREE E-books

In partnership with IRS Solutions, Lambers is now including the following 5 E-Books free with the Tax Resolution Certificate Series:

- 10 Tips for an Easier Filing Season:

WHAT ACCOUNTANTS AND TAX PROS NEED TO KNOW - 6 Tax Resolution Mistakes When Working an Offer in

Compromise (OIC) and How to Avoid Them - 8 Tips to Boost Offer in Compromise (OIC) Acceptance Rates

- The Value of Proactive IRS Audit Monitoring

- Marketing Your Firm: A Survival Guide for Tax Pros. This guide will help accountants like you market your services.

Tax Resolution Courses

Are you tired of working long-nights, having ungrateful clients that don’t appreciate you?

Are you fed up with Congress making last minute changes to the tax laws in the middle of the season – and then extending the deadline?

Isn’t it time you thrived all year long instead of relying solely on tax season?

The Lambers 10 course Tax Resolution Series, taught by the popular Eva Rosenberg EA, CTRS. is designed to provide a solid foundation for tax practitioners to handle all areas of IRS representation. This course will make it possible for you to get your fair share of business in this 400+ billion dollar arena.

You will learn about IRS ethical standards, how to avoid conflicts of interest – and, most of all – how to be a hero to your clients!

This series of courses includes:

- 1) Foolproof Tips to Release IRS Levies on Paychecks or Bank Accounts

- 2) Resolving Collection Issues

- 3) Preparing for an OIC

- 4) Preparing Collections Forms

- 5) 1040 Audit

- 6) After SUCCESSFUL Collections or Audits

- 7) When Collections and Audits Fail -Appeals

- 8) Computing or Recalculating IRS Interest & Penalties

- 9) Conflicts of Interest

- 10) Circular 230 Issues and Updates

Why do you need Tax Resolution training?

Source: https://www.getcanopy.com/blog/pricing-tax-resolution

This 10-part series is designed to provide a solid foundation for tax practitioners to handle all areas of IRS representation. This course will make it possible for CPA firms, law firms and EA firms to keep the representation in-house, instead of continuing to farm out the lucrative cases to other tax professionals – and potentially lose the client, long-term.

This series will give you the tools to handle all these IRS representation areas, effectively: audit, collections, levy release and appeals. Specific guidance and tips are provided to succeed at audits – or to prevail in appeals; to prepare and present an Offer in Compromise with the lowest legally acceptable balance due; to put collections actions on hold, to get levies released – and how to appeal collections decisions when they are not in your clients’ favor. You will also learn how to fix failed audits and collections cases started by the client – or other tax professionals who couldn’t help your clients.

You will learn about IRS ethical standards, how to avoid conflicts of interest – and, most of all – how to be a hero to your clients!